A Structured Approach to Cost Reduction

Managers are increasingly considering the implications of price and cost manage- ment from a total supply chain perspective, as shown in Exhibit 11.1. In the past, many companies focused their cost efforts on internal cost management initiatives. These included approaches such as value analysis, process improvements, standardiza- tion, improvements in efficiency by utilizing technology, and others. Although these approaches are still relevant, the impact that they have on the majority of costs is not as great as in the past. Why? With the increased amount of outsourcing occurring in every global company today, the majority of the cost of goods sold is driven by suppliers, which are outside the four walls of an organization. In this environment, organizations wanting to fully capture the benefits of cost-reduction initiatives must implement approaches that include both upstream and downstream members of their supply chains. Such a change requires a fundamental shift in thinking in the minds of managers and employees.

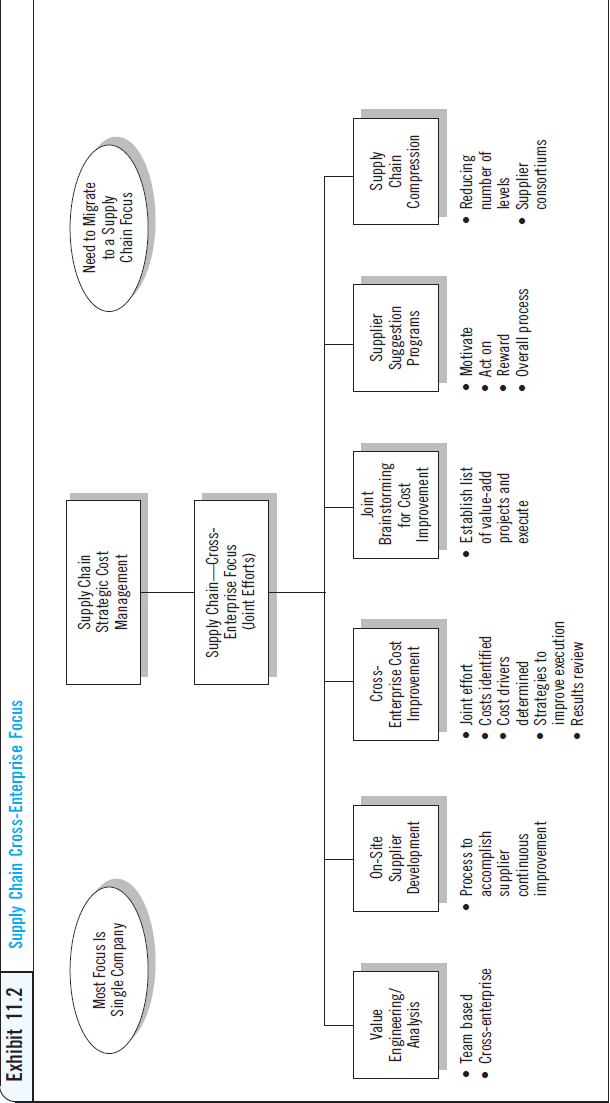

This new generation of cost management initiatives requires that supply management and logistics executives adopt a series of new initiatives that can deliver results to the bottom line. As shown in Exhibit 11.2 on p. 404, strategic cost management approaches typically involve at least two supply chain partners working together to identify process improvements that reduce costs across the supply chain. Examples include team-based value-engineering efforts, supplier development and kaizen events, cross-enterprise cost- reduction projects, joint brainstorming efforts on new products, supplier suggestion pro- grams, and supply chain redesign efforts. These types of efforts require that both parties commit to achieving cost-reduction strategies that go beyond simple haggling over prices.

Strategic cost management approaches will vary according to the stage of the product life cycle. As shown in Exhibit 11.3, various approaches are appropriate at different product life cycle stages. In the initial concept and development stage, supply management will often act proactively to establish cost targets. Target costing/target pricing is a technique developed originally in Japanese organizations in the 1980s to combat the inflation of the yen against other currencies. Target pricing, quality function deployment, and technology sharing are all effective approaches for cost reduction used at this stage.

As a product or service enters the design and launch stages, supplier integration, standardization, value engineering, and design for manufacturing can improve the opportunity to use standard parts and techniques, leverage volumes, and create opportunities for cost savings. During the product or service launch, supply management will adopt more traditional cost-reduction approaches, including competitive bidding, negotiation, value analysis, volume leveraging, service contracts focusing on savings, and linking longer-term pricing to extended contracts. As a product reaches its end of life, supply management cannot ignore the potential value of environmental initiatives to remanufacture, recycle, or refurbish products that are becoming obsolete. As an example of this, print cartridge manufacturers such as Xerox and Hewlett-Packard have developed innovative technologies that allow customers to recycle laser toner cartridges, which are subsequently refurbished and used again, eliminating landfill costs.

The major benefits from cost-reduction efforts occur when supply management is in- volved early in the new-product/service development cycle. When sourcing decisions are made early in the product life cycle, the full effects of a sourcing decision over the product’s life can be considered. When supply management is involved later in the product development cycle, efforts to reduce costs have a minimal impact because the major decisions regarding types of materials, labor rates, and choice of suppliers have already been made. A manager in a major automotive company described this situation asfollows: “In the past, we allowed engineering to determine the specifications, the materials, and the supplier. In fact, the supplier already produced the first prototype. That is when they decided to call in supply management to develop the contract. How much leverage do you have in convincing the supplier to reduce costs when the supplier al- ready knows they are guaranteed the business, and they have already sunk money into a fixed design and tooling for the product?”1

When prioritizing efforts to reduce costs, companies often apply a structured frame- work for cost reduction similar to the one illustrated in Exhibit 11.4. This framework is consistent with the portfolio analysis framework developed in Chapter 6 and should be integrated into an organization’s category strategy development process. As shown in Exhibit 11.4, each approach requires a different strategic focus in terms of price versus cost. In general, low-value generics in which a competitive market with many potential suppliers exists should emphasize total delivered price. There is no need to spend time conducting a detailed cost analysis for low-value items that do not produce significant returns. Greater returns can be obtained by having users order these products or services directly through supplier catalogs, procurement cards, or other e-procurement technologies. Commodities are high-value products or services that also have a competitive market situation; for example, computers and technology are certainly in this category (as discussed in the opening vignette). These types of products and services can be sourced through traditional bidding approaches that require price analysis using market forces to do the work and identify what is a competitive price. With greater standardization being introduced in many industries, products once considered as critical are being moved into the commodities quadrant.

Unique products present a different challenge: Companies must strive to reduce costs for products with few available suppliers, yet that are still low value. Examples include suppliers of unique fasteners, specialty papers, and specialty MRO items. For such items, purchasers will want to identify suppliers that are charging too high a price. Further analysis of their pricing through a technique known as “reverse price analysis” (discussed later in the chapter) may identify price discrepancies that can be reduced through greater standardization of user requirements or ongoing negotiations with problematic suppliers. In effect, this may mean transitioning a product or service from the unique quadrant to the generics quadrant. Many of the commodities previously thought to belong in the generics quadrant are shifting to strategic, based on global capacity and demand forecasts for 2011 onwards.

Sourcing Snapshot Cost Effective Options to Business Travel: Trends in Procurement

With the recent downturn in the economy, companies are facing challenging times and higher costs across the board. Managers are attempting to increase the bottom line and eliminate un- necessary spending in their annual expenses. To combat rising prices, corporate travel is being reevaluated and companies are becoming more involved in procuring and formalizing the most cost-efficient practices in their company policies. These practices include setting up preferred suppliers in regards to air travel, ground transportation, and lodging, or outsourcing this part of the business to travel agencies or services that already have the tools in place to a make cost- efficient decisions and track them. Companies need to develop practices that will enable them to make the best decisions.

According to Business Travel News, policies should be developed by answering questions involv- ing the following criteria: Firms need to figure out internally who (person, department, or com- mittee) should be responsible for writing the policy. A policy then needs to be established as to who will make the travel arrangements and the time frame for their approval. Then appropriate procedures need to be set regarding air travel, lodging policies, ground transportation, meals, and entertainment practices.

Payment methods to these organizations or reimbursement and expense reporting should be formalized in a company policy. Finally, how the travel policy will be communicated within the organization and the annual review of these policies should be spelled out. Consolidating company travel into preferred suppliers will give companies more leverage in their negotiating power, which can lead to lower costs and better service from those suppliers.

A recent research study carried out by a team of MBA students at North Carolina State University explored a number of trends in travel spending. The team found that more than 85 percent of companies are facing increasingly tighter travel restrictions. The results established that most companies do not have a department that makes decisions regarding traveling and meetings. Furthermore, most companies are currently using some alternatives to travel, and they seem to be willing to invest in new communication technologies to further reduce travel expenses. Seventy-one percent of the companies think that they have well-prepared travel policies. However, these policies do not usually have a procedure which helps employees choose between travel and alternatives. When it comes to meetings, most companies showed that there are no set para- meters to deal with meeting policies. In addition, most companies agreed that their meetings are not reviewed by a central financial unit.

The survey included a detailed analysis of five current alternatives of travel: TelePresence, HD videoconferencing, ISDN videoconferencing, web conferencing, and phone conferencing. Phone conferencing had the highest usage (96 percent), with web conferencing in second place with 82 percent. The more expensive alternatives such as ISDN videoconferencing, HD videoconferenc- ing, and TelePresence had a much lower usage by the companies, with more than half of the respondents not having one or more of these technologies.

There was a strong link between companies’ revenues and their use of TelePresence or HD video- conferencing. Companies with revenues over $15 billion use TelePresence frequently, while those with revenues under $250 million were the largest group that did not own the technology. There was an even distribution of companies that use and have ISDN videoconferencing systems. The survey divided the companies into the categories of advanced, mid-level, and low-level adopters. Thirty-seven percent of the companies were advanced adopters, 29% were mid-level, and the remaining 34 percent were low-level adopters. The different levels were closely related to the revenues of the companies.

The advanced adopters had the highest use of HD and TP systems; thirty-six percent of those surveyed stated they used these systems more than 20 times a week. As expected, they had a lower usage of ISDN videoconferencing systems with 37 percent stating they use these only zero to five times a week. In general, these companies were more satisfied with the perfor- mance of HD and TP systems compared to ISDN. They also showed to be more satisfied with the ROI from their HD and TP systems, and a large group is replacing traveling with HD or TP.

Finally, a decision support tool was developed to help companies to decide when to use travel and when to choose an alternative. The tool is a simple Excel spreadsheet model where employ- ees can describe the type of meeting they have by selecting criteria from a drop-down menu.

Based on their description of the meeting, the tool recommends what is most appropriate in each case; i.e., whether to use TelePresence, HD/ISDN videoconferencing, web/phone conferencing or actually attend the meeting in person. Scrutiny of travel vs. other forms of communication will continue to be an important element of cost management in the future.

Source: Appaji, S., Kasamovic, A., Brown, J., Mittendorf, V., and Velarde, G.,“Business Travel Survey,” (2009, April). White Paper, Supply Chain Resource Cooperative, NC State University.

The major focus of a purchaser’s efforts to reduce costs should be on critical products where relatively few suppliers exist but the items are higher value. Managers should com- mit time to exploring opportunities for value analysis/engineering, cost-savings sharing, collaborative efforts focused on identifying cost drivers, and supplier integration early in the product development cycle. Cost analysis involves breaking down a supplier’s price into its cost elements to uncover potential cost savings and, hence, price reductions.

The remainder of this chapter presents a discussion of price analysis (commodities and generics quadrants), cost analysis (unique and critical quadrants), and total cost analysis (all four quadrants) that can be applied to help control the costs associated with these different purchased goods and services.